The Power of 房屋二胎: A Comprehensive Guide for Banks & Credit Unions

In the competitive landscape of the banking and credit union industry, staying ahead of the curve is essential for sustainable growth and success. One of the key financial solutions that have been gaining significance in recent years is 房屋二胎.

Understanding 房屋二胎

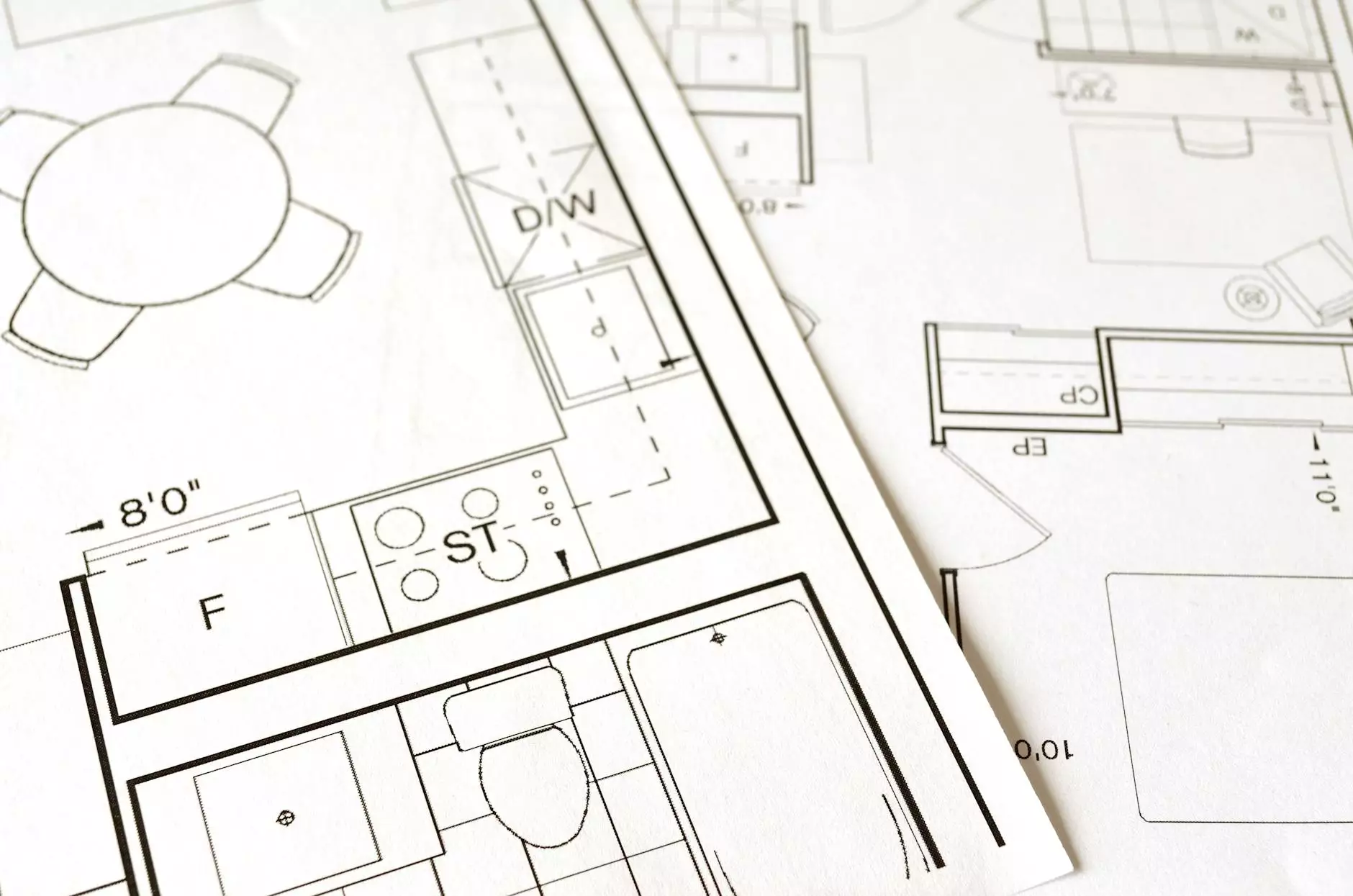

房屋二胎, translated as "second mortgage" in English, refers to the process of obtaining a loan against the equity of a property that has already been mortgaged. This financial instrument allows businesses to leverage the value of their real estate assets to access additional capital for various purposes.

Benefits for Banks & Credit Unions

Banks and credit unions play a crucial role in facilitating 房屋二胎 transactions, providing businesses with the necessary funds while mitigating financial risks. By offering this financial product, financial institutions can benefit in several ways:

- Diversification of Services: By incorporating 房屋二胎 into their product offerings, banks and credit unions can diversify their service portfolio, catering to the evolving needs of businesses.

- Risk Management: Through stringent evaluation processes and collateral requirements, financial institutions can minimize the risk associated with 房屋二胎 transactions, safeguarding their interests.

- Revenue Generation: 房屋二胎 transactions can be a lucrative source of revenue for banks and credit unions, generating interest income and fees while supporting business growth.

Strategic Considerations

When venturing into the realm of 房屋二胎, banks and credit unions must adopt a strategic approach to maximize the benefits while ensuring responsible lending practices. Key considerations include:

- Risk Assessment: Conducting thorough risk assessments to evaluate the creditworthiness of borrowers and the adequacy of collateral is essential in mitigating potential defaults.

- Regulatory Compliance: Adhering to regulatory guidelines and compliance requirements is imperative to maintain the integrity of 房屋二胎 transactions and uphold market ethics.

- Customer Education: Educating customers about the benefits and risks of 房屋二胎 can enhance transparency and trust, fostering long-term relationships with borrowers.

Impact on Business Growth

Utilizing 房屋二胎 as a financial tool can significantly impact the growth trajectory of businesses, allowing them to:

- Expand Operations: Accessing additional capital through 房屋二胎 can provide businesses with the resources needed to expand operations, enter new markets, or invest in innovative ventures.

- Manage Cash Flow: By injecting liquidity into the business, 房屋二胎 can help companies address short-term financial challenges and maintain stable cash flow.

- Seize Opportunities: Leveraging the equity in real estate assets enables businesses to seize growth opportunities promptly, capitalizing on market trends and competitive advantages.

Conclusion

In conclusion, 房屋二胎 presents a compelling opportunity for banks and credit unions to partner with businesses and foster financial growth and stability. By understanding the nuances of this financial instrument and implementing sound lending practices, financial institutions can unlock new avenues for revenue generation and support the success of their clients.